Some experts say that you should review with your Estate Lawyer your Plan at least ever four (4) years.

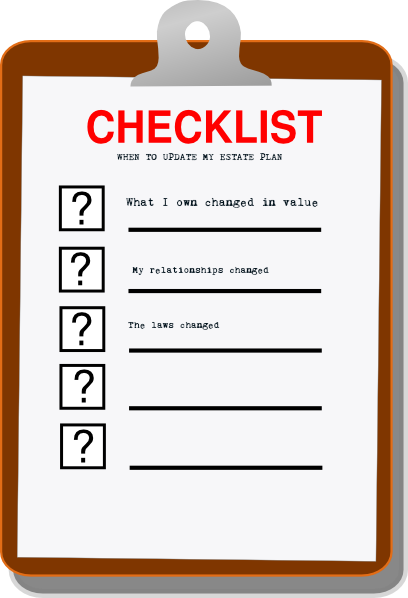

Remember that there are three (3) parts of your Estate Plan that are always moving:

- What you own will change,

- your relationships will change, and

- the law will change.

Since these three (3) major pieces that affect your Estate Plan are always moving, you should have your Estate Plan reviewed every several years and at any time there are major changes in your life.

Certain Life Events will Trigger a Need to Update and Revise Your Estate Plan

Changes in Values of What you Own.

An inheritance or an increase in the value of what you own may trigger a need to revise your Plan.

If you receive an inheritance from a loved one that increases the value of your estate you may want to change how your assets are distributed after your passing.

Your land may have increased in value.

Here in Western North Carolina we have certainly seen an increase in land value. Rural farmland that once had a low value, suddenly has a high value as land around it is developed and as more retirees move into the area. Also the value of our homes have increased.

If the value of your investments have increased significantly you should review your Estate Plan.

Changes with Your Loved Ones.

If your loved ones go through a serious illness, it may impact how you want to leave your assets. If they are going through a divorce or lawsuit, you may want to be more protective in how you provide the inheritance to them.

Changes with You.

If you go through a remarriage you will want to modify your Estate Plan. Blended families often bring balancing acts to your Estate Plan. If your new spouse is supportive, encouraging and really improves your life, then you may want to provide a larger amount of your assets for them, or have assets available for their benefit while they are alive. After they pass on, those assets can move back to your birth children.

If you go through a divorce you want to make sure that your Estate Plan is revised so that your ex-spouse is no longer a beneficiary. You will also want to make sure that they are not named as a Death Beneficiary on your Life Insurance, your Work Retirement Accounts, IRA, Annuities or Certificates of Deposit. You do not want them named on anything that moves by title after someone passes on.

If you have children, or your adult children have children, either by adoption or by birth, you may want to provide for that child or grandchild. Many grandparents provide for their grandchildren’s education as part of their Estate Plan.

Summary

Again, there are always a number of personal, financial, and legal reasons to review your Estate Plan on a regular basis. Make sure that yours is up to date so that your Estate Plan matches what you own, your needs, those of your loved ones, and the law.

At the Law Firm of Steven Andrew Jackson, Attorney and Counsellor at Law, we have helped hundreds of families protect themselves and their loved ones, avoid Estate Taxes and Probate Costs, and keep their Estate Plans current with the law through The Customized Protective Estate Planning Solution™.